Post Time:Nov 07,2011Classify:Company NewsView:568

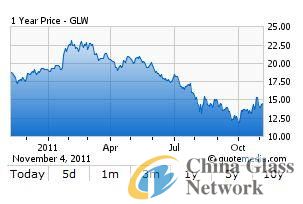

Corning Incorporate (GLW), a manufacturer of substrates and glass products for the technology industry, has taken a large hit this year. Shares are down by nearly a quarter while the S&P is up by 2.2%. As the leading producer of ceramics and glass substrates for LCD, Corning however does not have to worry about its competitive position like other producers in technology. As the business is in a trough period, in my view, it is trading at a substantially depressed valuation.

From a multiples perspective, the stock is cheap at only 6.9x and 7.7x past and forward earnings. It may have a beta of 1.43, but its dividend yield of 2.06% and net cash position of $4.1B, 18% of market capitalization, helps reduce the risk. Accordingly, analysts rate the stock around a "buy" with 14 of the 20 revisions being made upwards.

At the recent third quarter earnings call, CFO Jim Flaws noted:

30% year-over-year, and with EPS, excluding special items, at $0.48. In summary, Telecom, Environmental, Specialty Materials and Life Sciences all had significant year-over-year growth. Glass line in our wholly owned business -- Display business did better than our realized expectations from early September. SCP volumes did not decline as much as we anticipated but were still down significantly sequentially. Our quarter 3 results did benefit from the strengthening of the yen...

Despite the continued strong retail environment, panel makers ran at much lower utilization rates during the third quarter, especially in Korea. Strong retail demand in Q3, coupled with lower production rates, led to a significant contraction in supply chain inventory during the quarter. We believe supply chain inventories exited the quarter around 14 weeks.

While I find the shares undervalued, the lower utilization rates and pricing pressure does give me pause. Despite likely higher utilization rates during the fourth quarter for Korean panel, growth elsewhere will be stagnant. In addition, glass volume was down by more than 20% at SCP and lost market share. I still nevertheless believe that high demand for LCD televisions and a better than expected semiconductor industry will be a value driver for high risk-adjusted returns in the near future.

While I find the shares undervalued, the lower utilization rates and pricing pressure does give me pause. Despite likely higher utilization rates during the fourth quarter for Korean panel, growth elsewhere will be stagnant. In addition, glass volume was down by more than 20% at SCP and lost market share. I still nevertheless believe that high demand for LCD televisions and a better than expected semiconductor industry will be a value driver for high risk-adjusted returns in the near future.

Perhaps the greatest risk concerns 2012 royalty income. In a filing, Corning noted that its agreement with Samsung Corning Precision will expire by the end of the year and it may have to decrease its rate by more than 50%. In addition, top customers are contributing more to revenue in the third quarter than they were in the second quarter - a trend that has considerable implications on pricing power. At the earnings call, the CFO noted that it is able to charge a premium for its glass products on the market, but that this pricing is largely a function that varies based on how much glass is ordered by any one particular customer. Top consumers contributing a larger percent to revenue is thus naturally resulting in pricing pressure and Corning will be accordingly cutting prices. Glass prices have so far declined 15% y-o-y - better than expectations - and this trend is likely to continue into 2012.

Lower planned capital expenditures for the next year at $1.8B also makes me question the stability of the business, but this general fear has already been well priced into the stock, as evidenced by the very low multiples. While volumes were down by 20%, this was 1000 basis points better than expected. Going forward, I am optimistic that management will optimize the supply chain to deal with the cyclicality of the business. In particular, Gorilla glass for TVs will help to boost demand.

Consensus estimates for EPS are that it will decline by 11.1% to $1.84 in 2011 and then increase by 2.7% and 5.3% in the following years. Assuming a conservative 2012 EPS of $1.86 and a 12.5x multiple, substantially lower than any reasonably similar firm, the intrinsic value is $23.25 as a base case - thus offering a healthy margin of safety.

In conclusion, while I believe there is substantial risk to owning the stock given macro headwinds, I am optimistic that the shares are cheap enough to justify the risk, especially given the substantial cash holding. Over the next few quarters, this cash can be possibly be applied to higher-growth acquisitions that will reduce risk in the long-term. The future in LCD sales and telecommunication equipment is bright, in my view, and Corning - as the market leader of necessary inputs in this field - will substantially benefit.

Source: http://seekingalpha.com/article/305670-corning-glaAuthor: shangyi

PrevJapan Stocks: Asahi Glass, Furukawa, Mitsumi, Osaka Exchange

PPG donates $55K to COSI for Innovations in Energy project, ongoing supportNext