Post Time:Dec 30,2017Classify:Industry NewsView:925

After reading Sejal Glass Limited’s (NSEI:SEZAL) most recent earnings announcement (30 June 2017), I found it useful to look back at how the company has performed in the past and compare this against the latest numbers. As a long-term investor I tend to focus on earnings trend, rather than a single number at one point in time. Also, comparing it against an industry benchmark to understand whether it outperformed, or is simply riding an industry wave, is a crucial aspect. Below is a brief commentary on my key takeaways.

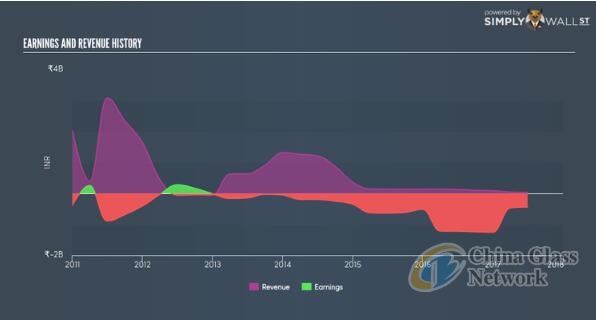

I look at data from the most recent 12 months, which either annualizes the most recent 6-month earnings update, or in some cases, the most recent annual report is already the latest available financial data. This method allows me to assess different stocks on a more comparable basis, using the most relevant data points. For Sejal Glass, its most recent earnings is -₹438.8M, which compared to last year’s figure, has become less negative. Given that these values may be relatively nearsighted, I’ve determined an annualized five-year value for Sejal Glass’s earnings, which stands at -₹417.1M. This suggests that, Sejal Glass has historically performed better than recently, even though it seems like earnings are now heading back towards to right direction again.

Additionally, we can examine Sejal Glass’s loss by looking at what’s going on in the industry as well as within the company. Initially, I want to quickly look into the line items. Revenue growth over the past couple of years has been negative at -36.32%. The key to profitability here is to make sure the company’s cost growth is well-controlled. Scanning growth from a sector-level, the IN building industry has been enduring some headwinds over the prior twelve months, leading to an average earnings drop of -3.60%. This is a momentous change, given that the industry has been delivering a positive rate of 9.90%, on average, over the previous few years. This means even though Sejal Glass is presently running a loss, any recent headwind the industry is enduring, the impact on Sejal Glass has been softer relative to its peers.

While past data is useful, it doesn’t tell the whole story. Companies that incur net loss is always hard to forecast what will happen in the future and when. The most useful step is to assess company-specific issues Sejal Glass may be facing and whether management guidance has consistently been met in the past. You should continue to research Sejal Glass to get a more holistic view of the stock by looking at:

1. Financial Health: Is SEZAL’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you.

2. Valuation: What is SEZAL worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether SEZAL is currently mispriced by the market.

3. Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records?

Source: www.yahoo.com Author: shangyi

PrevPrice of shahe huibo changcheng float glass on December 30th, 2017

Price of Shandong Fangding laminating Glass Equipment on December 30th, 2017Next