Post Time:Jun 24,2022Classify:Industry NewsView:1214

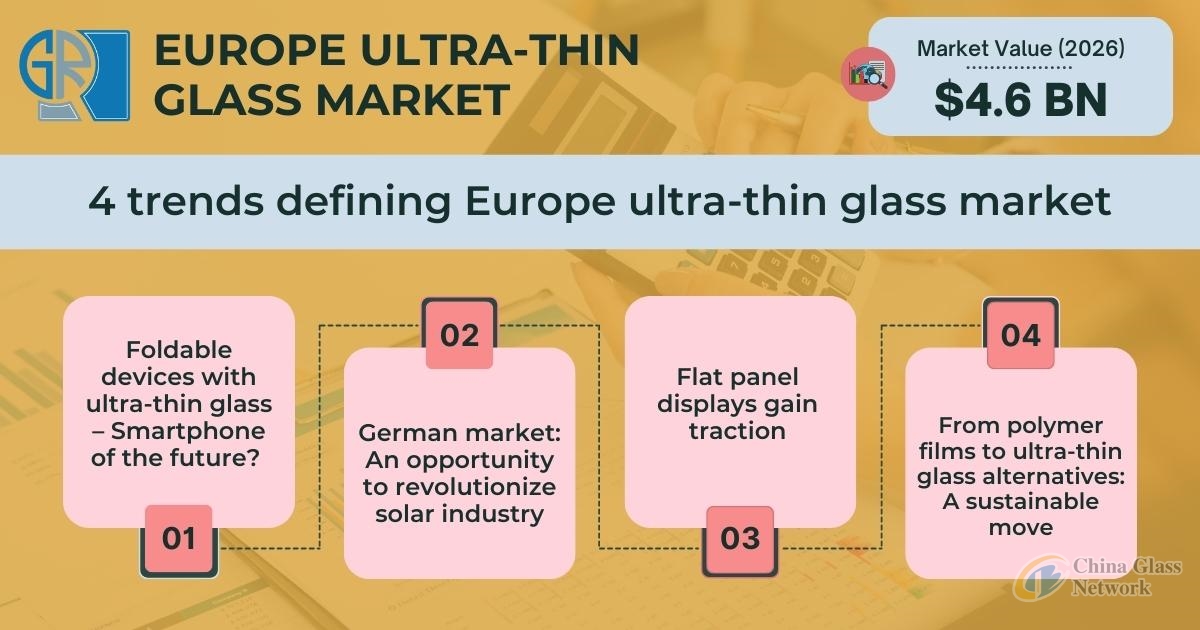

As per a recent industry report put forward by Graphical Research, the Europe ultra-thin glass market is forecast to register its name in the billion-dollar fraternity down the line of seven years, by exceeding a revenue of USD 4.6 billion by 2026.

Europe ultra-thin glass market trends reveal the wide-ranging scope for expansion from flat panel displays and semiconductors substrate applications. Global environmental concerns have accelerated the use of solar energy across the European Union. As modern solar PV systems are incorporating ultra-thin glass owing to its lightweight properties, the renewable energy goals are expected to be a key driver of the market.

The Europe industry growth is triggered by the growing consumption of solar energy across Denmark, Sweden, and Finland. As per the EU goals, a minimum of 32% of total energy must be represented by renewables by 2030 by member countries.

The below-mentioned trends will help push the industry forecast up to 2026:

Foldable devices with ultra-thin glass – Smartphone of the future?

As foldable ultra-thin glass phones are becoming a rage, the touch-control segment is expected to accelerate Europe ultra-thin glass industry forecast. In 2021, Korean smartphone giant Samsung launched two foldable phones, the Galaxy Z Flip 3 and the Galaxy Z Fold 3, featuring a clamshell design. Leading glass manufacturer Corning Inc. is supplying ultra-thin glass for these foldable phones. The company has announced plans integrate the ultra-thin technology with gorilla glass for more durable screens.

German market: An opportunity to revolutionize solar industry

A revolution in the solar energy industry is well underway since researchers at Fraunhofer Institute for Applied Polymer Research IAP, Germany, started testing the organic solar photovoltaics (OPVs), which could address the problem of short operating life. Preliminary testing has shown promising results as the new type of paper-thin glass manufactured by Corning will be fracture-resistant and flexible. With latest developments supporting Germany ultra-thin glass market forecast, solar panels can be used in everyday items.

Flat panel displays gain traction

The flat-panel displays accounted for the dominant share of the ultra-thin glass market in Europe during 2019, with touch-control devices holding nearly 34% in the same year. The spiraling demand for consumer electronics is responsible for the trend. Ultra-thin glass is being used in flat-screen products such as laptops, televisions, tablets, and automotive displays as well. Ultra-thin glass displays feature properties such as highly responsible touch, lightweight, and ultra-clarity.

From polymer films to ultra-thin glass alternatives: A sustainable move

In view of the stringent regulations pertaining the use of polymer films, several companies are replacing them with ultra-thin glass alternatives. Top industry players including Schott and Nippon Glass are embracing eco-friendly methods for manufacturing flexible glass screen. Significant investments in the electronics industry are likely to focus on reducing the environmental impact of manufacturing practices, thereby fueling Europe ultra-thin glass market size by 2026.

CGS HOLDINGS LTD., Nippon Sheet Glass Co., Ltd., Corning Inc., AGC Inc., Pilkington, Taiwan Glass, Luoyang Glass Co., Ltd., Aircraft Glass, and Emerge Glass are some leading ultra-thin glass manufacturers in Europe. Industry participants are offering robust features in their products. For instance, Schott provides razor-thin glass that is scratch-resistant, bendable, and unbreakable.

Source: https://www.globenewswire.com/Author: shangyi

PrevConstruction, Motor Vehicle Markets To Boost US Flat Glass Demand'

Pilkington UK supplies glazing for Elizabeth Line platformsNext