Post Time:Oct 22,2024Classify:Industry NewsView:1019

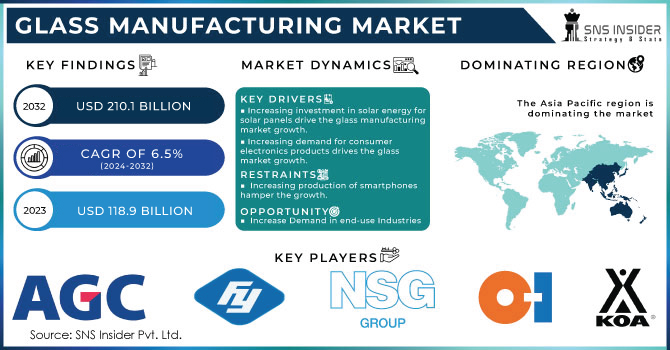

Austin, Oct. 21, 2024 (GLOBE NEWSWIRE) -- The Glass Manufacturing Market Share was valued at USD 118.9 billion in 2023 and is expected to reach USD 210.1 billion by 2032 and grow at a CAGR of 6.5% over the forecast period 2024-2032.

Book Your Sample PDF for Glass Manufacturing Market Report @ https://www.snsinsider.com/sample-request/1444

The glass manufacturing market is experiencing robust growth, driven by rising demand from sectors such as construction, automotive, and consumer goods. Increased construction activities in emerging economies have heightened the need for glass in building facades and windows, while the automotive industry’s shift toward lighter, fuel-efficient vehicles has boosted demand for advanced glass technologies like laminated and tempered glass. Environmental regulations are prompting manufacturers to innovate with eco-friendly production methods. For instance, in February 2023, Arglass secured a $230 million investment for a glass furnace initiative, demonstrating a commitment to modernizing operations and enhancing production capabilities. Furthermore, in May 2024, an unnamed Indian glass manufacturer partnered with a green hydrogen supplier to reduce carbon emissions in production, aligning with global sustainability goals. Additionally, a major player announced plans in January 2024 to establish a cover glass manufacturing facility in SIPCOT Pillaipakkam, responding to the growing demand for specialized glass products. Collectively, these developments underscore the industry's proactive stance in adapting to market dynamics while prioritizing innovation and sustainability.

Segment Analysis

In 2023, the building and construction segment dominated the glass manufacturing market, accounting for approximately 40% of the total market share. This dominance is primarily attributed to a surge in construction activities globally, particularly within residential and commercial projects. The growing trend of modern architecture, which prioritizes natural light and energy efficiency, has significantly increased the demand for glass products like windows, doors, and curtain walls. For example, many urban development’s feature expansive glass facades that not only enhance visual appeal but also contribute to energy savings by minimizing reliance on artificial lighting. Moreover, the emphasis on sustainable building practices has driven the adoption of energy-efficient glass solutions, such as triple-glazed or low-E glass, further fueling the growth of the building and construction segment. This trend underscores the crucial role of glass in contemporary architecture and urban planning, reinforcing its status as the top end-use application in the market.

Key Players in Glass Manufacturing Market

AGC Inc. (flat glass, automotive glass, specialty glass)

Amcor (glass bottles, jars, glass containers)

Central Glass Co. Ltd. (automotive glass, architectural glass, container glass)

Fuyao Glass Industry Group Co., Ltd. (automotive glass, flat glass, energy-saving glass)

Guardian Industries (float glass, mirror glass, coated glass)

Heinz Glass (glass containers, custom glass packaging, food and beverage jars)

Koa Glass (automotive glass, architectural glass, tempered glass)

Nihon Yamamura (glass containers, tableware, laboratory glass)

Nippon Sheet Glass Co., Ltd (float glass, automotive glass, architectural glass)

Owens Illinois Inc (glass containers, bottles, jars)

Saint Gobain (flat glass, insulating glass, laminated glass)

Sisecam Group (container glass, flat glass, glassware)

Trivium Packaging (glass containers, bottles, food packaging)

Verallia (glass containers, bottles, jars)

Vitro (automotive glass, flat glass, container glass)

O-I Glass, Inc. (glass bottles, jars, food containers)

PPG Industries, Inc. (coated glass, specialty glass, automotive glass)

Corning Incorporated (specialty glass, optical fiber, consumer glassware)

Mitsubishi Chemical Holdings Corporation (glass fiber, specialty glass, engineering plastics)

Schott AG (specialty glass, pharmaceutical glass, display glass)

Key Raw Material Suppliers in the Glass Manufacturing Market:

Soda Ash Suppliers

Tronox Limited

Solvay S.A.

FMC Corporation

Silica Sand Suppliers

U.S. Silica Holdings, Inc.

Fairmount Santrol (now part of Unimin)

Hi-Crush Inc.

Limestone Suppliers

Carmeuse Lime & Stone

Mississippi Lime Company

Lhoist Group

Alumina Suppliers

Alcoa Corporation

Rio Tinto Group

Norsk Hydro ASA

Feldspar Suppliers

The Feldspar Corporation

Imerys S.A.

Sibelco Group

Boric Acid Suppliers

Borax (a subsidiary of Rio Tinto)

Eti Maden

American Borate Company

Cullet Suppliers (recycled glass)

Strategic Materials, Inc.

Glass Mountain Capital, LLC

Sustainable Glass Solutions

Iron Oxide Suppliers

Lanxess AG

Huntsman Corporation

Tosoh Corporation

Magnesia Suppliers

Martin Marietta Materials, Inc.

Magnesita Refratários S.A.

Garrison Minerals, Inc.

Zinc Oxide Suppliers

Zochem, Inc.

American Zinc Recycling Corp.

Sumitomo Chemical Co., Ltd.

Regional Analysis

In 2023, North America dominated the glass manufacturing market, boasting a market share of approximately 35%. This dominance is largely due to the region's strong construction sector, which is experiencing significant growth driven by urbanization and infrastructure development. The United States, in particular, has seen an uptick in both residential and commercial building projects, leading to increased demand for flat glass and specialty glass products. For example, major cities like New York and Los Angeles are experiencing a boom in high-rise constructions that heavily incorporate glass for both aesthetic appeal and functionality. Furthermore, advancements in energy-efficient glass technologies, spurred by stringent building codes and sustainability regulations, have reinforced North America's market leadership. The region's dedication to innovation and quality in glass manufacturing also plays a vital role in sustaining its dominance.

SNS View on Glass Manufacturing Market

The glass manufacturing market is anticipated for significant growth driven by technological innovation and an increasing focus on sustainability. Penetration of smart and energy-efficient glass solutions is changing the game and serving specific needs from eras for various industries. A key driver belongs to the construction industry, which is witnessing a growing green building trend with a bias toward smart infrastructure. The demand for specialty glass in the automotive and electronics sectors also benefits the market. However, companies equally have to face issues relating to high production costs and volatility in raw material prices through innovation and strategic collaborations in such a way as to surmount the odds and help tap into new growth opportunities. However, with the growing wave of digitalization across manufacturing processes, particularly in terms of the use of IoT and AI for better quality control and efficiency, the prospects of this market segment are further enhanced. On the whole, the market for glass manufacturing presents a dynamic landscape with enormous opportunities for growth and innovation.

Recent Developments:

In 2024, Beta Glass, has partnered with Wecyclers to improve recycling in Nigeria by launching cullet trucks for glass transportation.

In 2023, Saint-Gobain launched a new glass with a low carbon footprint. The motive of new product development is reducing emissions.

In 2022, Chiefway expand its smart glass factory in Malaysia. The company expanded its business unit to raise the demand for smart home development products.

Source: www.globenewswire.comAuthor: shangyi

PrevIndia's first borosilicate glass furnace set up in this city... - Details

Glass Performance Days and glasstec Collaborate for Industry AdvancementNext